Product Analytics: How to Control Plan Execution in a Startup

Podcast created by NotebookLM by Google

When developing a startup, it is crucial to learn how to formulate goals and tasks using the S.M.A.R.T. methodology. This approach, introduced in the 1980s, provides clear and simple criteria to assess the likelihood of task completion and goal achievement. However, simply formulating tasks and goals is not enough—you also need to regularly compare planned business indicators with actual results by conducting what is known as a plan-vs-actual analysis.

Traditionally, a plan-vs-actual analysis involves reviewing financial documents, such as comparing forecasted P&L or CF reports with actual results, and making decisions based on deviations. However, I propose a slightly different approach.

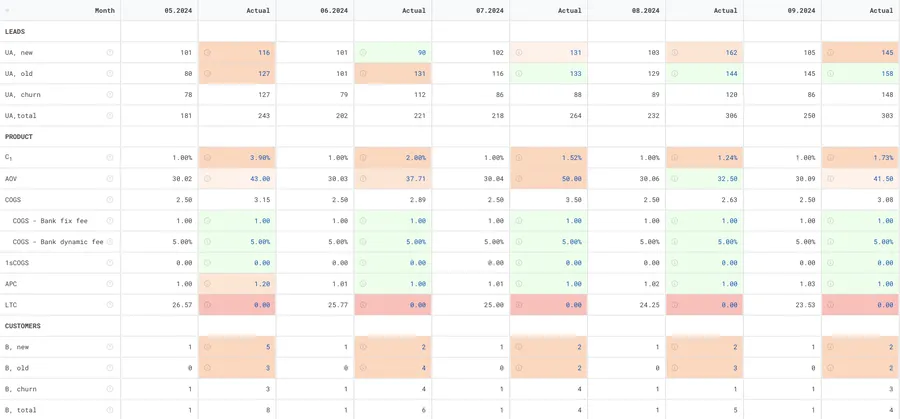

First, I view the product as a process management system, and I build the business’s financial indicators by digitizing these processes and applying unit economics. This means analyzing processes, metrics associated with them, forming unit economics based on these metrics, and then using this data to generate financial documents such as P&L, CF, and Balance.

The logic behind this approach is that businesses should be accountable for the actions they take, not for the derived financial indicators. For instance, our objective is not simply to achieve a monthly revenue of 100,000€ but to perform the actions necessary to reach this result.

This is why, in the ueCalc service, financial documents are accompanied by a product plan. This plan outlines the month-by-month changes in business process metrics required to achieve the specified financial targets.

Consequently, plan-vs-actual analysis should align strictly with this approach. We compare planned improvements in business processes (how we expect to change the processes and their related metrics) with actual results.

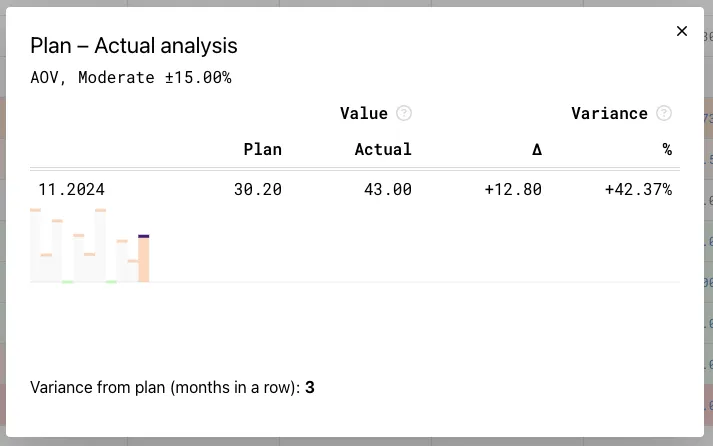

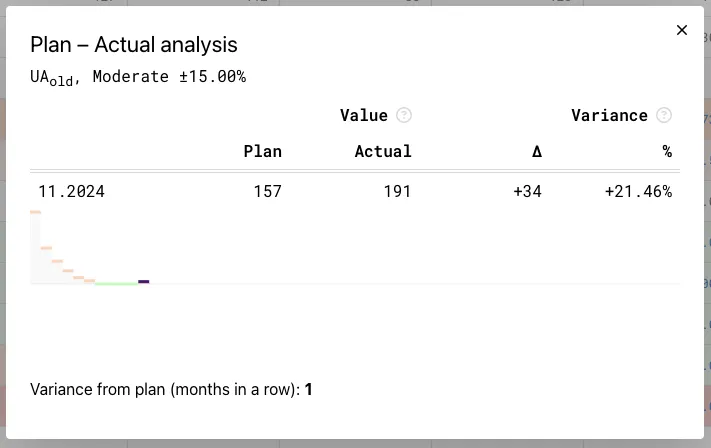

Deviations between actual metrics and planned metrics allow us to assess the effectiveness of business processes. It becomes immediately apparent which process is not performing as planned. For example, if a metric consistently exceeds its planned value for three consecutive months, this could indicate either overestimation during planning or an overly cautious approach.

Conversely, if deviations are negative, it means the process is underperforming compared to the plan. The analysis can also show how a process is gradually aligning with its planned values.

It is essential to understand the factors driving process improvements and determine what levels of deviation are acceptable for your business.

In any case, plan-vs-actual analysis within the framework of product analytics helps identify which specific processes are diverting your financial plan from target indicators. When metrics are structured correctly, you can assess business processes in detail and gain a better understanding of what is happening in your business.

Business planning in ueCalc is built around a small number of metrics. Only the key indicators necessary for unit economics calculations are used. This enables startups to evaluate the efficiency of their processes without expending significant effort, as most of the work is automated.

Product-focused plan-vs-actual analysis helps promptly identify inefficient processes and make focused management decisions. This approach conserves a startup’s resources and ensures effective progress toward its goals.

To say thank you and show support for future content.

50€/annually

To gain access to commentary and content, please consider subscribing.

If you're already a customer, just log in.

we do not store your email, only the encrypted hash, which increases the security of your email.